The Minister of Finance and Economic Planning Dr. Uzziel Ndagijimana today, on behalf of Government, presented the 2020/2021 revised budget to members of parliament.

Ndagijimana virtually presented the revised budget in line with cabinet resolutions to contain COVID -19 pandemic as well as the Supreme Court ruling allowing parliament to conduct virtual plenary sittings.

“The budget revision process has been informed by the economic and budget performance for the first quarter of 2020/21 which includes the assessment of the COVID-19 economic effects and provision of necessary support to vulnerable households, create jobs and support businesses,” Minister Ndagijimana said.

Key changes in FY 2020-2021 Revised Budget

The proposed revised budget presented to parliament contains key adjustments which include rise in domestic revenues due to projected increase in taxes following recovery of economic activities and businesses. Reclassification of budgetary loans to budgetary grants due to changes in disbursement plans. On the expenditure front, Government expects to increase recurrent spending to cater for COVID-19 related expenditures, increase in net lending outlays to support business through the Economic Recovery Fund as well as state corporations.

Resources

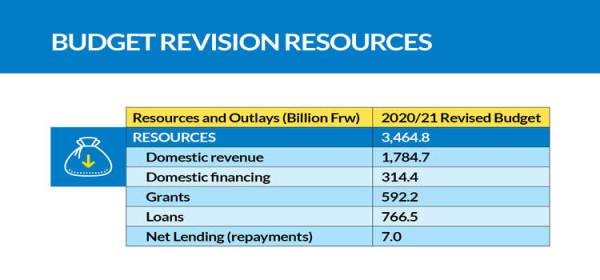

The proposed revisions to the 2020/21 budget reflect changes in the resource envelope as well as the corresponding adjustments on expenditures. As a result of the proposed changes, the total budget is projected to rise from Frw 3,245.7 billion to Frw 3,464.8 billion showing an increase of Frw 219.1 billion.

Domestic resources are expected to increase by Frw 179 billion from Frw 1,605.7 billion in the original budget to Frw 1,784.7 billion representing a 11.1 % increase.

This increment will come from all tax categories namely direct taxes, taxes on good and services and taxes on International trade as a result of economic recovery in doing business as well as improved collection of taxes

Tax revenues are projected to increase by Frw 158.5 billion, from Frw 1,421.4 billion in the original budget to Frw 1,579.9 billion. Non tax revenue is expected to increase by Frw 20.5 billion upwards from Frw 184.3 billion to Frw 204.8 billion. Grants are expected to rise by Frw 99.7 billion, upwards from Frw 492.5 billion in the original budget to Frw 592.2 billion.

Expenditure

Total expenditure is being raised from Frw 3,245.7 billion to Frw 3,464.8 billion showing a net increase of Frw 219.1 billion. The expenditure has been revised to reflect changes made under recurrent spending, capital expenditure and net lending outlays.

Recurrent Expenditure will be raised by Frw 12.4 billion from Frw 1,583.0 billion from the original budget estimate to Frw 1,595.4 billion. Capital expenditure is expected to rise by Frw 37.6 billion, from Frw 1,298.5 billion in the original budget to Frw 1,336.1 billion.

The changes majorly affect the domestically financed capital expenditures. Net lending increased by Frw 165.2 billion from Frw 306.5 billion in the original budget to Frw 471.7 billion. This increase in the Net lending outlays are mainly allocated to the Economic Recovery Fund as the continued effort of the Government to support Businesses affected by COVID-19 pandemic outbreak.

The 2020/21 revised budget is part of the revised medium term macro-economic framework that aims to continue fighting the COVID-19 pandemic outbreak which continues to take a heavy toll on Rwanda’s economy. The Government will continue to monitor closely all components of the economic performance that may affect the smooth implementation of the revised 2020/21 budget, and will take any necessary corrective measures to ensure full implementation of the budget and at the same time maintain macro-economic stability.(End)